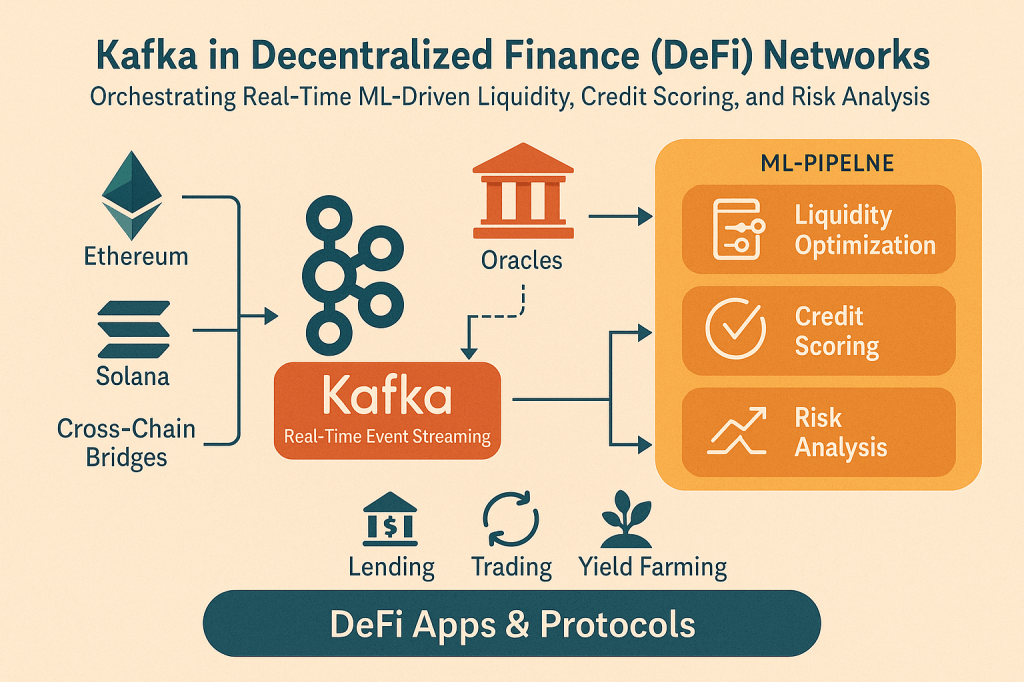

Orchestrating Real-Time ML-Driven Liquidity, Credit Scoring, and Risk Analysis

Decentralized Finance (DeFi) has grown into one of the most disruptive movements in finance, promising open, transparent, and trustless financial services without intermediaries. Yet, beneath the surface lies a key challenge: real-time data orchestration. To power lending, trading, and risk management in a decentralized environment, DeFi systems must process enormous volumes of data flowing across blockchains, smart contracts, and user wallets.

This is where Apache Kafka comes in. Kafka acts as the backbone for streaming data across DeFi ecosystems, enabling real-time pipelines that support machine learning (ML)-driven decision-making for liquidity management, credit scoring, and risk analysis.

Why Kafka for DeFi?

Unlike traditional finance, DeFi operates on multiple blockchains with asynchronous, distributed events. Liquidity pools are constantly updated, smart contracts are triggered by user actions, and cross-chain bridges relay transactions. Kafka’s strengths, low-latency, scalability, and event-driven architecture, make it ideal for orchestrating this complexity.

- Real-Time Streams: Capture and normalize blockchain events (e.g., token swaps, lending actions) as they happen.

- Cross-Chain Integration: Act as a unified streaming layer across multiple DeFi protocols and chains.

- ML Enablement: Feed continuous data to machine learning pipelines for live scoring and predictions.

Real-Time Liquidity Management

Liquidity pools are the lifeblood of DeFi. Mispricing, slippage, or imbalance can erode trust. Kafka enables:

- Streaming market feeds from exchanges and AMMs (Automated Market Makers).

- Dynamic pool balancing via ML models that detect anomalies in token ratios.

- Automated liquidity provisioning that responds instantly to demand.

By integrating Kafka with on-chain oracles, DeFi platforms can predict liquidity shortages and rebalance in real time.

ML-Driven Credit Scoring in DeFi

Traditional credit scoring relies on centralized data (bank accounts, credit history). DeFi lacks these inputs—but offers new signals: wallet history, transaction patterns, collateral management, and even governance activity.

Kafka can:

- Aggregate on-chain and off-chain data into a credit profile stream.

- Continuously feed ML models that update creditworthiness scores.

- Trigger smart contract actions for loans (approve, reject, adjust collateral).

This real-time, streaming-based scoring system makes lending more inclusive while maintaining risk controls.

Continuous Risk Analysis

Risk in DeFi isn’t static, it evolves with every block. Protocol exploits, flash loan attacks, and cross-chain vulnerabilities demand continuous monitoring. Kafka enables:

- Anomaly detection pipelines that flag suspicious trading or sudden liquidity drains.

- Stress test simulations in real time against live market conditions.

- Event correlation across multiple protocols for systemic risk insights.

With ML-driven detection models consuming Kafka streams, DeFi platforms can move from reactive defense to proactive risk management.

The Future: DeFi + Kafka + AI

The convergence of DeFi, Kafka, and ML represents a new frontier in decentralized finance. Picture this:

- Self-healing liquidity pools that rebalance automatically.

- Decentralized credit bureaus powered by streaming credit scoring.

- Autonomous risk engines that adapt instantly to evolving threats.

By embedding Kafka into DeFi architectures, we move closer to trustless yet intelligent financial ecosystems—where data streams fuel smarter, safer, and more resilient networks.

DeFi promises openness, but openness without stability is fragile. Kafka bridges this gap, providing the real-time data infrastructure that lets ML models make decentralized finance both intelligent and trustworthy. The future of finance won’t just be decentralized, it will be streaming and AI-driven.

Leave a comment