Digital asset exchanges thrive on speed, liquidity, and global access. But with opportunity comes risk: fraud, market manipulation, and opaque behaviors erode confidence. In a domain where trust is the currency, financial institutions and regulators need more than black-box AI — they need auditable, explainable ML pipelines that can be trusted at scale.

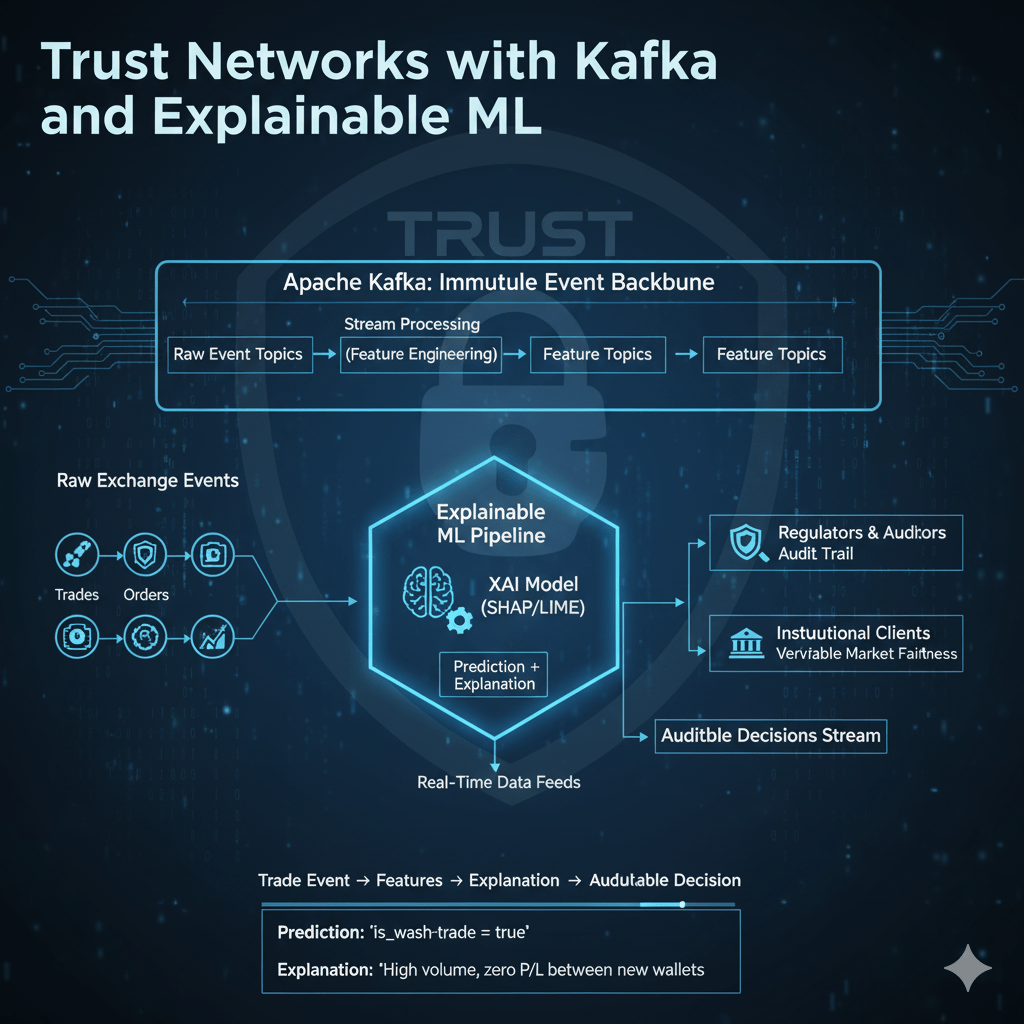

Apache Kafka, combined with explainable machine learning (ML), provides the backbone for building trust networks that monitor, classify, and secure digital asset transactions in real time.

The Challenge: Trust in a High-Velocity Market

- Opaque decision-making: Many exchanges rely on black-box models that flag suspicious activity without clear reasoning.

- Regulatory pressure: Laws demand transparency around how financial institutions detect fraud and manage risk.

- Scale and speed: Billions of microtransactions flow across exchanges daily, requiring millisecond-level detection and auditing.

Without explainability and governance, ML becomes a liability instead of an asset.

Kafka as the Trust Backbone

Kafka enables streaming-first trust architectures where every event — from trades to wallet transfers — is captured, enriched, and monitored in real time.

- Data Ingestion

- Kafka collects streams from trading engines, KYC systems, blockchain ledgers, and market feeds.

- Immutable event logs ensure full traceability.

- ML Pipeline over Streams

- Stream processing frameworks (Kafka Streams, Flink) apply feature engineering and feed models.

- Models detect anomalies (e.g., wash trading, pump-and-dump behavior, unusual liquidity movements).

- Explainability Layer

- Techniques like SHAP or LIME explain why a transaction was flagged.

- Explanations are logged back into Kafka alongside predictions, forming an auditable record.

- Trust Network Outputs

- Regulators access an auditable trail of flagged events and explanations.

- Exchanges build trust dashboards showing real-time risk levels across counterparties.

Example: Auditable Trust in Action

A digital asset exchange detects unusual trading in a new token.

- Kafka ingests order book updates and wallet transfers.

- An ML model flags the behavior as suspicious due to rapid cyclical trades.

- The explainability module highlights the key features: “High frequency of trades between the same wallets,” “Volume spike vs. baseline.”

- The flagged record, with explanation, is logged into Kafka for audit.

Now, when regulators review, the exchange can prove why and how the decision was made, not just that it happened.

Benefits of Trust Networks

- Transparency: Every flagged event includes a clear reasoning trail.

- Auditability: Kafka’s immutable log acts as the single source of truth for regulatory compliance.

- Collaboration: Multiple exchanges can share explainable signals via Kafka without exposing raw customer data.

- Confidence in Digital Assets: Improves investor trust by showing exchanges are actively monitoring with accountable AI.

The Future of Trust Layers

In digital asset markets, explainability is becoming as important as accuracy. By combining Kafka’s real-time streaming with explainable ML, exchanges can build trust networks that scale, adapt, and comply with evolving regulatory demands.

Trust networks are more than a technical fix — they are the foundation for digital asset markets to evolve into mature, transparent, and widely trusted ecosystems.

Leave a comment