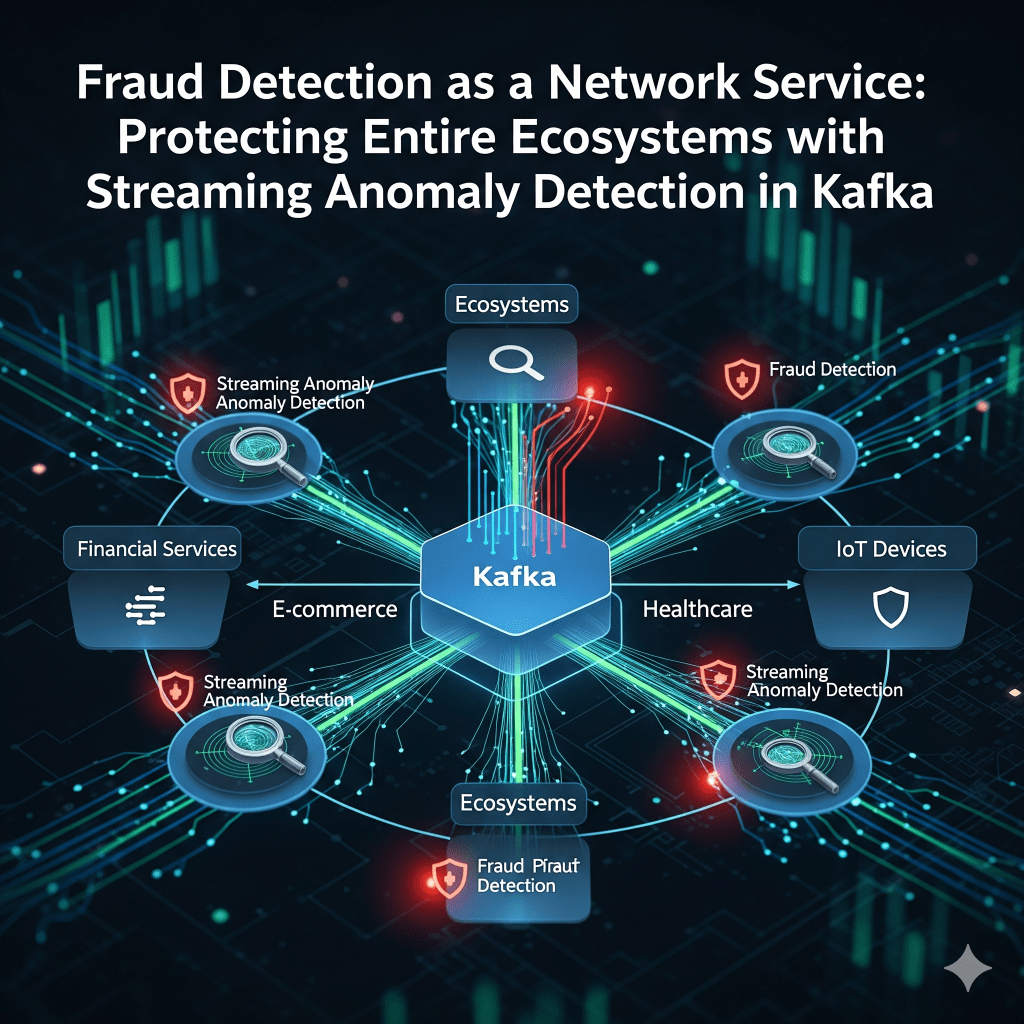

Fraud is no longer a problem confined to one company, it has become a network-level threat. From financial institutions to e-commerce platforms, fraudsters exploit the interconnected nature of digital ecosystems, moving quickly across borders and channels. This shift calls for a new approach: fraud detection as a shared network service.

Why Network-Level Fraud Detection?

Traditional fraud detection models operate in silos, analyzing transactions within a single firm. This creates blind spots—fraudulent behavior detected in one place often re-emerges elsewhere in the ecosystem. A network business model changes the game: participants share anonymized signals of suspicious activity in near real-time, turning isolated defenses into a collective shield.

Kafka as the Streaming Backbone

Apache Kafka provides the ideal foundation for network-level fraud detection because of its ability to:

- Stream in Real Time: Suspicious transaction signals can be broadcast instantly across banks, payment gateways, or digital platforms.

- Scale with Velocity: Millions of transactions per second can be ingested and analyzed without bottlenecks.

- Enable Feature Sharing: Derived features (e.g., unusual login patterns, transaction spikes, device fingerprint mismatches) can be shared across participants as Kafka topics.

- Integrate with ML Models: Kafka Streams or Flink pipelines can run ML anomaly detection models continuously, flagging threats before they spread.

Anomaly Detection Pipelines in Action

- Data Ingestion: Multiple firms publish transaction, login, and behavioral data streams into Kafka topics.

- Feature Engineering: Real-time pipelines extract features such as transaction velocity, geolocation anomalies, or unusual device use.

- Model Scoring: ML models (e.g., isolation forests, graph neural networks, or deep autoencoders) process the streams to score for anomaly likelihood.

- Alert & Response: High-risk events are broadcast back into the network, triggering blocks, step-up authentication, or audits across all participants.

This transforms Kafka into not just a data bus, but a shared defense fabric.

Benefits to the Ecosystem

- Collective Intelligence: One participant’s detection helps the entire network.

- Reduced False Positives: Broader context makes anomaly scoring more precise.

- Regulatory Alignment: Shared fraud detection aligns with compliance expectations for systemic risk management.

- Trust & Retention: Customers benefit from safer, smoother transactions.

Fraud detection as a network service is more than a technical architecture, it’s a business model innovation. Just as platforms like Visa or SWIFT coordinate global financial flows, future ecosystems may offer “fraud detection as a subscription service”, powered by Kafka and ML. Firms that once competed on isolated security can now collaborate on trust, strengthening the entire digital economy.

✅ Takeaway: Kafka-enabled streaming anomaly detection pipelines shift fraud prevention from individual defense to collective intelligence. In a hyper-connected world, protecting ecosystems is the only way to protect firms.

Leave a comment